Stop the Spend Creep: 7 SaaS Contract Negotiation Checks to Make Before Signing or Renewing

Control software spend, negotiate contracts fairly and align investments with value.

After reviewing millions of dollars in SaaS contracts across dozens of LLR portfolio companies, we have seen how even disciplined teams can experience software spend creep, where licenses or subscriptions accumulate gradually over time. Tools that once fit your business may no longer align with current needs. Renewals roll over automatically, seat counts expand quietly and new features get added without real adoption. The result: rising costs while value stays flat.

This article outlines seven steps to help CFOs, department leaders or any budget owners control software spend, negotiate contracts fairly and align investments with value.

To know if a quote is competitive, you need to know the discount you’re receiving off the list price.

1. When Given a Contracted Price, Ask for the % Off List Price

To understand whether a software quote is competitive, you need to know how much of a discount you’re receiving off the list price: the vendor’s standard, non-discounted rate for a subscription, license or feature.

Gartner research (as cited by GetMonetizely) indicates most competitive enterprise software discounts typically fall in the 20 – 50% off list price range, with some deals reaching 70% off list price.1 In our experience, when a vendor says, ‘this is our best rate,’ it rarely is. You could always ask: “What percent off list pricing does this represent?”

We often see vendors describe a “highly competitive rate” that turns out to be only a ~5% discount off list pricing. Because list prices typically carry large built-in margins – sometimes 75 – 90%2 – and that gap becomes your negotiation space. Even a 10-point difference in discount can translate into thousands in annual savings or tens of thousands over the life of a SaaS contract.

Then go a step further: Calculate the total discount across the entire contract.

We have seen 50% off a small add-on while the core platform fee is discounted only 0 – 5%. Deals like this can look generous on paper but deliver far less value in practice.

If recurring pricing won’t move, shift your focus to one-time fees.

When a vendor holds firm on subscription pricing, one-time fees like implementation, setup or onboarding are often negotiable. These costs can sometimes be reduced or waived entirely if the subscription pricing is fixed.

If you’re signing a multi-year contract, we recommend negotiating 3-year pricing with a 1-year exit.

Lock in lower rates now to help prevent feeling pigeonholed into inflated renewals later.

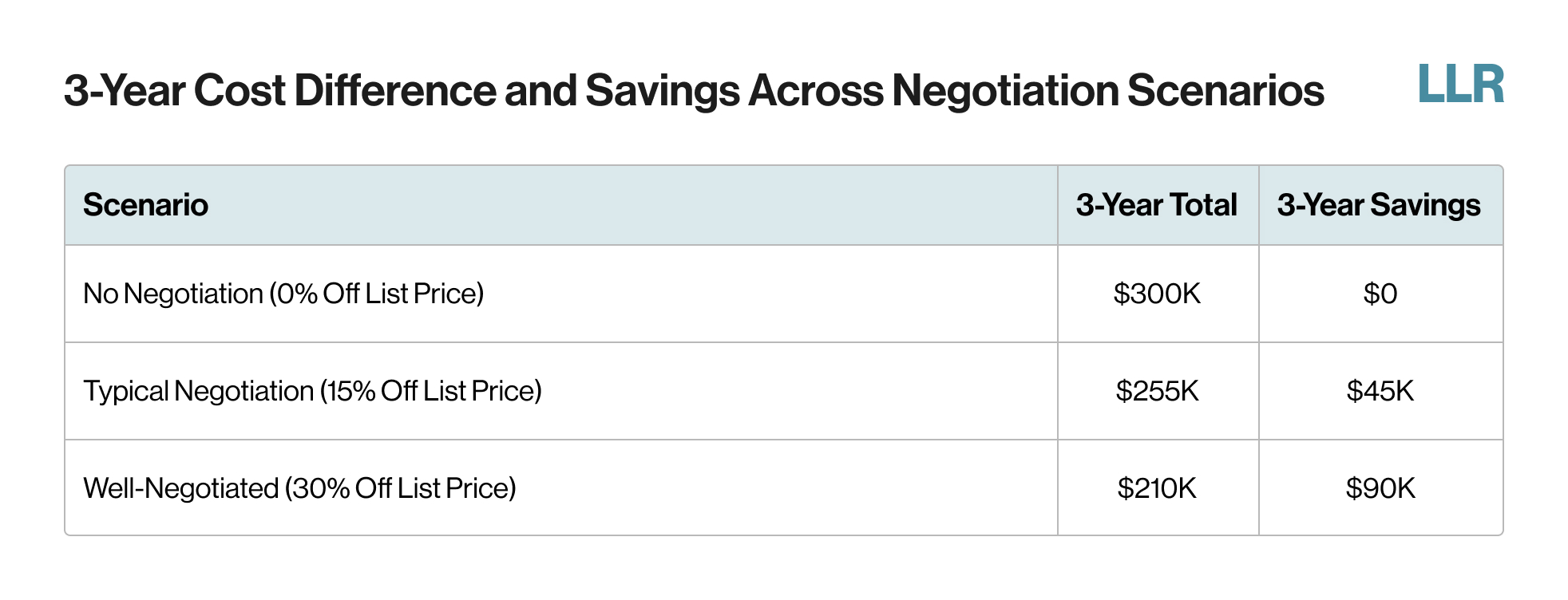

Renewal increases are typically based on your current price, not the list price. Starting high means overpaying every year that follows. Even minor differences add up quickly, as shown below:

2. Negotiate Contract Terms Beyond Price

The contract price is only half the story; contract structure is the other. Even when you don’t have as much pricing leverage as you’d like, you still likely have the opportunity to negotiate.

The chart below shows how typical negotiation leverage can shift based on the size of your SaaS contract and the vendor.

Push for a renewal cap, such as a flat 5% maximum upon renewal.

A price cap is a contract rule that prevents a software company from raising your price by more than a set amount each year. SaaStr’s 2025 Price Surge Report shows SaaS pricing is up ~8.7% year-over-year.3 A simple renewal clause serves as guardrails against unexpected price hikes.

If you’re signing a multi-year contract, and this is your first contract with the vendor, we recommend negotiating 3-year pricing with a 1-year exit. This can help lock in savings while giving you options if the tool underdelivers or your business changes.

It is commonplace for us to see unwanted SaaS contracts with expiration dates 1-2 years in the future. While some have successfully negotiated an exit, this takes ample time and is not always successful. This clause is more about smart risk management than mistrust. Think of the terms above as built-in security. Every clause saves you from a potential headache later.

Vendors are happy to sell more seats anytime but rarely let you remove them mid-contract.

3. Buy Only the Seats You’ll Use Today

Extra seats can quietly drain ROI. Vendors are happy to sell you more seats anytime but rarely let you remove them mid-contract. Start smaller and track usage quarterly to expand based on real adoption.

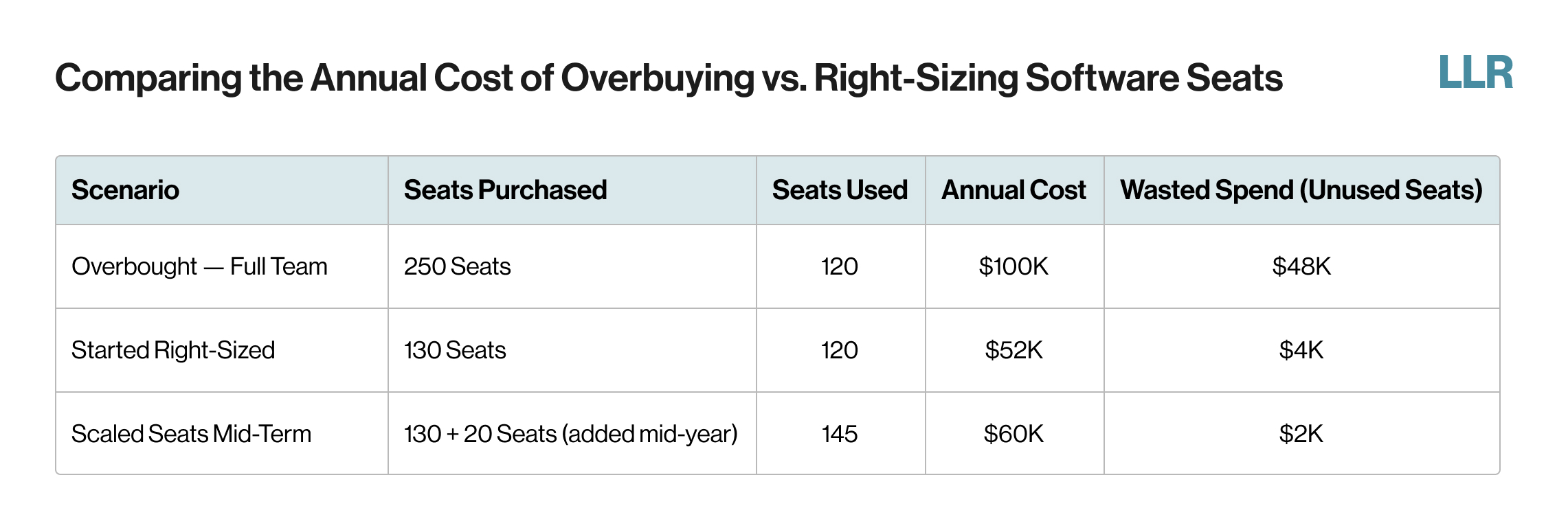

Here’s how this can play out in practice:

Starting lean could help you grow intentionally, whereas buying for “everyone” is often wasted spend that requires clean up later. Adding seats mid-year for legitimate adoption is smart spend, not waste. License by need, not headcount, and make expansion a reward for proven value.

Before every renewal, ask questions like:

- Who really uses this?

- Could we share licenses across roles or departments?

- Do we have multiple tools doing the same job?

Recent studies show 80% of software features are rarely or ever used.

4. Validate Add-Ons and “Enhancements”

AI modules, analytics packs, “pro” editions – they sound like progress, but often deliver little real value. A Pendo article stated 80% of software features are rarely or ever used.4 Not all add-ons are wasteful, but many don’t “earn their keep”. If usage and outcomes aren’t clear, skip it.

Before signing up for extra features, ask questions like:

- Is this filling a “need” or a “want”?

- What is our adoption plan?

- How will we measure ROI in six months?

5. Eliminate Internal Product Overlap

Before negotiating tools you may not even need, run a quick export from your general ledger or expense system to look for duplicates and similar tools solving the same problem in different departments. If you’ve completed M&A in the past, this is an especially important check. Cutting duplication can help deliver faster savings than price negotiations ever will.

Renewals are the time to evaluate whether tool adoption and value are up to par.

6. Review Renewal Value – Not Just Price

Renewals aren’t routine; they’re opportunities. Most companies treat them as a checkbox: “same tool, same terms.” But this is the best time to evaluate whether the tool still earns its place. Ask questions like the below to hold the team responsible for showing results:

- What does team adoption / satisfaction look like for this tool?

- Has this tool helped reduce another cost?

- Would we buy it again today at this price?

If the answers to these questions are not positive, it may be time to replace the tool. Vendors expect to be challenged at renewal and are looking to avoid churn. Many will work with you to ensure the deal still makes sense.

Every major tool should have a clear owner and a reminder set 60-90 days before the renewal date.

7. Track Renewal Dates

You have probably found yourself in this situation: you get an email asking, “Are we changing anything here?” referring to a renewal coming up in two weeks. Even if you wanted to negotiate, the time has passed. The spend isn’t that high, so you give the “OK” to renew.

This can happen when renewals sneak up unexpectedly. What was just a few thousand in neglected savings can quickly turn into hundreds of thousands of wasted spend. Establish clear ownership for renewals and set renewal “reminders.” Make sure every major tool has:

- A clear owner (someone who approves the renewal)

- A reminder set at least 60-90 days before the renewal date

Without this process, renewals can default to “auto-renew and hope for the best.” With it, you have time to renegotiate, reduce or retire the tools that no longer earn their cost. A simple tracker, like a spreadsheet or calendar reminder can make a difference.

Here’s the bottom line.

Smart software spend is about cutting what doesn’t deliver. Every time you benchmark pricing, negotiate terms or trim unused seats, you reclaim dollars. Those savings help to protect your margins, flexibility and future deals. Implement the checks mentioned above and you’ll not only stop spend creep; you’ll build a culture that treats every dollar like it matters.

These are practices we have applied across industries to help finance and operations leaders sustain growth efficiently. Whether you manage ten tools or a thousand, the same principles can apply. Disciplined spend management compounds just like revenue growth.

-

GetMonetizely, “Enterprise Discounting: How Much Is Too Much?” 2025, https://www.getmonetizely.com/articles/enterprise-discounting-how-much-is-too-much

-

BusinessDojo, “Software: Average Revenue, Profit and Margins,” BusinessDojo Blog, 2025, https://dojobusiness.com/blogs/news/tool-revenue-software

-

SaaStr / Jason Lemkin, “The Great SaaS Price Surge of 2025: A Comprehensive Breakdown of Pricing Increases and the Issues They Have Created for All of Us,” 2025, https://www.saastr.com/the-great-price-surge-of-2025-a-comprehensive-breakdown-of-pricing-increases-and-the-issues-they-have-created-for-all-of-us/

-

Pendo, “Solving the software experience crisis,” Pendo Blog, May 22, 2025, https://www.pendo.io/pendo-blog/solving-the-software-experience-crisis/

Delivered

Delivered