FP&A Best Practices and Why It’s One of the Most Critical Functions for CFOs

In a challenging market, FP&A is arguably the most critical function the Office of the CFO performs. Its benefits go beyond financial foresight and resilience, laying the groundwork for potential broad organizational success.

Financial planning and analysis (FP&A) has always been a vital function. But in our work with midmarket companies, we’re seeing its importance rising steeply, and in some cases, the level of urgency is taking even the Office of the CFO by surprise. When growth was easier and valuation multiples higher, FP&A was less critical. Today, higher cost of capital and hurdle rates have put pressure on CFOs to fully understand their business and levers to help effective decision-making.

In a challenging market and a slower economy, there is less margin for error. Every decision needs to be guided by precise, comprehensive and nuanced financial information, a principle that holds particular significance for companies managing substantial debt burdens. While accounting for the past through controllership is still important, FP&A, which focuses on anticipating and preparing for an unpredictable future, is now paramount.

As part of LLR’s Value Creation Team, I work closely with CFOs of growth-focused companies, and we are seeing a clear correlation between strong FP&A processes and exceptional CFO (and business) performance. In this GrowthBit, I’ll lay out the FP&A best practices and principles that characterize high-performing FP&A teams [or functions] across industries.

An 18-month rolling forecast approach ensures CFOs don’t find themselves starting from scratch during annual planning.

Build out multiple scenarios

FP&A exists to encourage forward thinking, identify risks and opportunities sooner, and helps to ensure there’s a plan in place to address them. We work with CFOs to build at least an 18-month view of the business that includes a baseline view of the future along with upside and downside cases. In other words, what will the company look like if it achieves its stretch goals? What if it only performs moderately? And what if it misses key targets by a significant amount?

This 18-month rolling forecast approach helps ensure CFOs don’t find themselves starting from scratch during annual planning. Instead, they have the data to communicate with and prime stakeholders with expectations for the following year well in advance of official budget meetings in December.

These scenarios can be run on an ad-hoc or quarterly basis and they don’t need to be shared externally, but they are a crucial tool for the CFO, allowing them to spot issues before they happen. A liquidity, covenant, or lender issue is much easier to work through if you see it coming two months, rather than two days, in advance, especially in highly leveraged environments.

Monitor cash flow

Cash is king in this market. CFOs must understand the cash flows of their business in addition to the P&L. All rolling forecast models should include a balance sheet and cash flow statement. These are no longer second-class financial statements.

In addition to the core 3-statement model, maintaining a 13-week cash flow forecast is non-negotiable. This should be a direct bottoms-up build of what you expect to collect and pay over the next quarter. Use this tool to help drive weekly A/P and A/R reviews with your teams. Be conservative here. A liquidity or covenant issue is much easier to work through if you see it coming two months, rather than two days, in advance, especially in highly leveraged environments.

Align the tools in your technology stack by setting cross-platform parameters that facilitate the flow of information between your core business platforms.

Get the cadence right

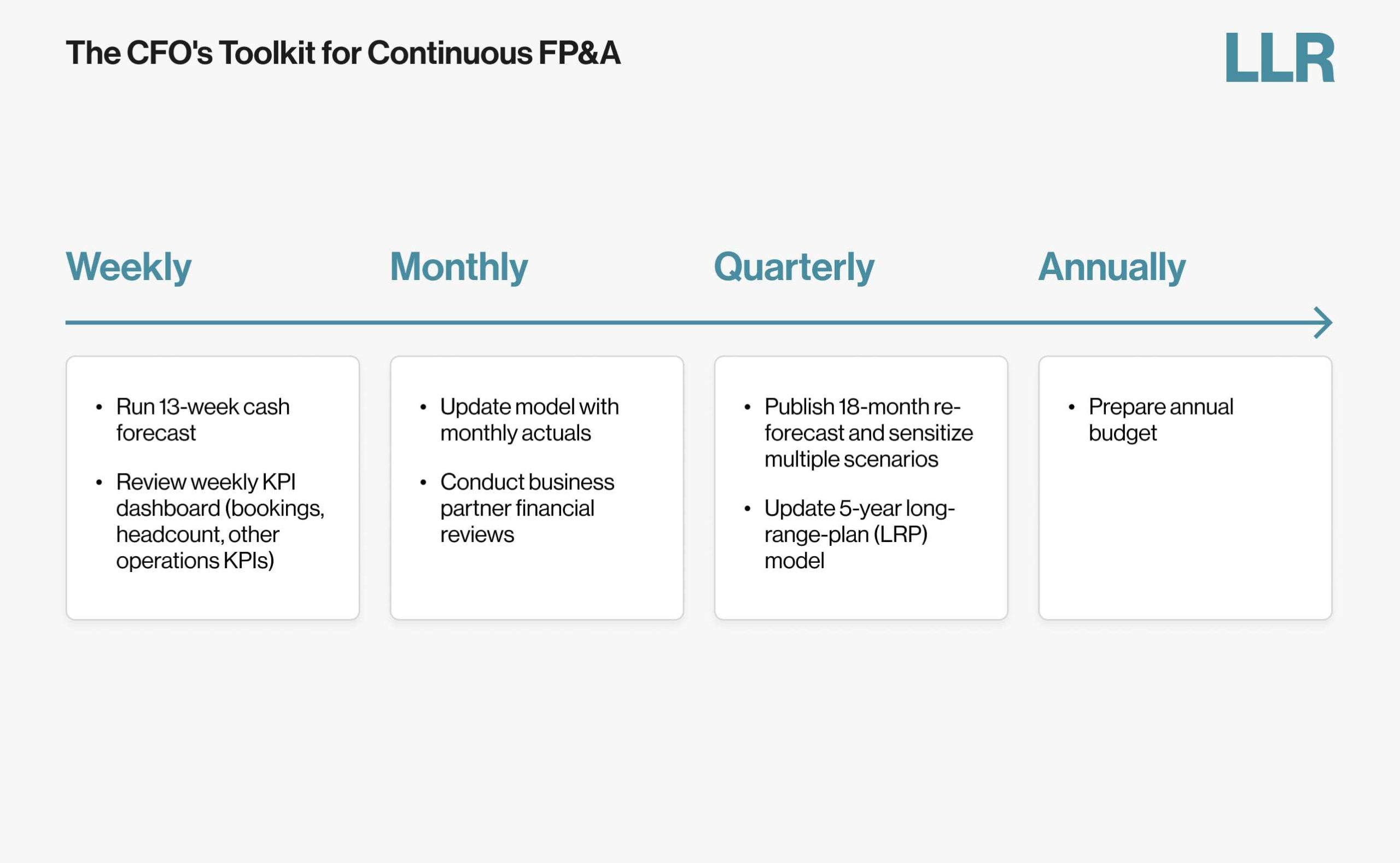

The strongest CFOs we have seen are the ones that look at FP&A as a continuous process rather than an annual occurrence. They update the forecast on a quarterly basis at minimum, with top players performing monthly rolling forecasts. Ideally, the CFO’s toolkit will include all these elements to help support continuous planning:

Align operational systems

The hardest part about forecasting is the amount of time it takes, and the most effective FP&A involves rolling forecasts. Rolling forecasts enable you to adapt dynamically to changing environments by continuously updating your financial outlook, promoting better resource allocation, strengthening risk management, and enhancing decision-making and stakeholder confidence.

To make forecasting a regular cadence, finance teams need a streamlined process where data collection and consolidation is as frictionless as possible. Having consistent, easy-to-update data across different systems and teams allows you to accomplish this.

The essential step here is to align the tools in your technology stack by setting cross-platform parameters that facilitate the flow of information between your core business platforms, including ERP, CRM and HRIS systems.

Whether you utilize specialized FP&A software or traditional spreadsheets, establishing a coordinated approach to data and dimension mapping across both systems and teams allows you to stay up to date with rolling forecasts. One of the first things our team does with every new portfolio company is map its chart of accounts and apply consistent dimensions and fields across systems. It’s our way of minimizing the manual effort involved in generating a holistic view of the business.

In fact, we see FP&A systems alignment and information flow as so critical to a CFO’s strategic decision making that LLR’s fintech investment team is actively focusing on pursuing investments in technology providers to the Office of the CFO that could be part of this tech stack.

I’ll also note the FP&A tool landscape has become more accessible. Planful and DataRails are examples of easy-to-use, cost-effective solutions in the market. We encourage companies to approach their FP&A technology needs like a product roadmap: determine your needs and the best time to deploy technology to streamline forecasting and reporting.

The best financial plans and forecasts are those built on an ongoing collaboration between finance and other business functions.

Create cross-functional collaboration

When FP&A is disconnected from operational realities, it can’t deliver value. Some of the best financial plans and forecasts we’ve seen are those built on an ongoing collaboration between finance and other business functions, underpinned by enhanced KPI reporting and deep analysis of business margins. They are ingrained in operational discussions and objectives, informed by steering committees, and baked into budgets and initiatives set by the operational leaders who are accountable for the expected outcomes and results.

The benefits of this approach go both ways. While it helps ensure management teams understand and are accountable to the financial model, it also means the CFO is aware of business projects and initiatives and able to translate them more effectively into financial outcomes and results. Ultimately, it brings the organization into deeper alignment around financial goals by encouraging operations to think more financially and finance to think more operationally.

Here’s the bottom line.

In a challenging market, FP&A is arguably one of the most critical function the Office of the CFO performs. Its benefits go beyond financial foresight and resilience, laying the groundwork for potential broad organizational success by giving everyone—whether internal leaders, sponsors or board members—the information they need to see the big picture, anticipate the challenges and find the best solutions. During times when performance can be volatile and time is of the essence, the impact of FP&A best practices that are aligned, nuanced, collaborative and consistent can be transformative.

Learn more about LLR’s team, experience and investment focus on technologies supporting the Office of the CFO.

This GrowthBit is featured in LLR’s 2024 Growth Guide, along with other exclusive insights from our portfolio company leaders and Value Creation Team. Download the eBook here.

Delivered

Delivered